Exchanges

FTX/Alameda

The SBF trial has been set to begin October 2, 2023

SBF has plead not guilty to all charges

SBF asked the judge to keep the 2 unnamed folks in his bail agreement confidential

The SEC is seeking more information into the due diligence done by investors in the company FTX per Reuters

Regulators have officially seized the Robinhood shares that SBF purchased (with FTX funds)

Former FTX regulatory chief Daniel Friedberg has been reported to be working with authorities in the investigation process

Friedberg has not been charged with any crimes

This is not the first time he has been involved in questionable activity

He previously worked at a company that was caught in an online poker scandal

Certain individuals had a “God mode” that allowed them to see all players hands while playing poker which allowed them to defraud others of millions

SBF either knew this or was ignorant to this fact when he hired Friedberg to be the top person for FTX’s regulation team

This week the Wall Street Journal reported that in 2018 Alameda almost went bankrupt and then FTX was created and user funds were utilized to help keep Alameda afloat

Binance

The SEC filed a limited objection the Binance-Voyager deal

Basically, the SEC wants more details in the transaction before approving it

One of the largest pharmacies in Ukraine is partnering with Binance to accept crypto payments

Binance acquired Gopax, one of the top 5 largest exchanges in South Korea

Celsius

Former CEO Alex Mashinsky is being sued by the Attorney General of New York

In a series of tweets, the AG stated that Mashinsky

Lied about the risks of investing in Celsius

Hid the deteriorating financial condition of the company

Failed to register in New York state

The AG claimed they “will continue to protect people from the risks of investing in cryptocurrency”

Many ask where they were before the collapse happened, and are upset those individuals and regulators like this AG, the SEC, and others are coming in with lawsuits after the fact and trying to capture headlines for themselves in the process for not just Celsius but in the other bankruptcies in the industry

A U.S. judge ruled that $4.2 billion of crypto deposits belong to Celsius and users gave up their rights to their assets by using the platform

This may not necessarily mean users will lose all of their funds

However, I cannot say enough: NOT YOUR KEYS NOT YOUR CRYPTO

Self-custody removes the risk of this happening!

Coinbase

Coinbase reached a $100 million settlement with New York regulators this week (via New York Times)

$50 million to improve their compliance

$50 million fined for opening customer accounts with inadequate background checks

Huobi

Huobi announced they are laying of 20% of their staff

They also denied insolvency rumors

The owner of Huobi is Justin Sun, who is known for getting his fortune in part as a founder of Tron, and is known as a risk taker

Tron’s token TRX currently has the 17th largest market cap among crypto tokens

Sun is a controversial figure in the industry

If you want to learn a bit more about him, here is an article https://www.theverge.com/c/22947663/justin-sun-tron-cryptocurrency-poloniex

Gemini-DCG

Gemini’s COO Noah Perlman left the company this week

On January 2nd Cameron Winklevoss of Gemini sent an open letter to Barry Silbert of DCG

Silbert replied to the tweet saying:

DCG did not borrow $1.675 billion from Genesis

DCG has never missed an interest payment to Genesis and is current on all loans outstanding; next loan maturity is May 2023

DCG delivered to Genesis and your advisors a proposal on December 29th and has not received any response

Winklevoss replied with:

There you go again. Stop trying to pretend that you and DCG are innocent bystanders and had nothing to do with creating this mess. It's completely disingenuous.

So how does DCG owe Genesis $1.675 billion if it didn't borrow the money? Oh right, that promissory note...

There were no further replies from Silbert after this on Twitter

The Gemini customers impacted were on the Earn platform within Gemini, and not on the exchange side of things with Gemini holding digital assets that were not staked/generating yield. This Earn program was done in partnership with Genesis and parent company Digital Currency Group. This is not to say that Gemini is without blame in the situation. Afterall, they were the ones that vetted Genesis and agreed to do this deal with them.

The way things look as of now, there will not be a resolution by the January 8th deadline given by Cameron Winklevoss. This will then almost certainly lead to legal action. Folks on the Gemini side are accusing Silbert and DCG of stall tactics, while Genesis says this is a complex issue that will take time to resolve, and I think the truth lies somewhere in the middle.

It is worth noting the DCG has not just Genesis in their portfolio, but they also have:

Grayscale

Billions of $ in crypto assets under management

GBTC is one of the largest single holders of Bitcoin in the world

Coindesk

A digital asset news company

Foundry

One of the larger bitcoin mining companies

Luno

An exchange with more than 5 million customers internationally

Genesis was impacted by the FTX collapse, and this week they laid off 30% of their workforce which is about 60 positions.

Late Friday night Bloomberg has reported that the SEC and prosecutors in the Eastern District of New York are investigating DCG over internal transfers/comingling of funds.

There will be a lot more to come from this, and the impact on the industry could be major if you don’t already think it is!

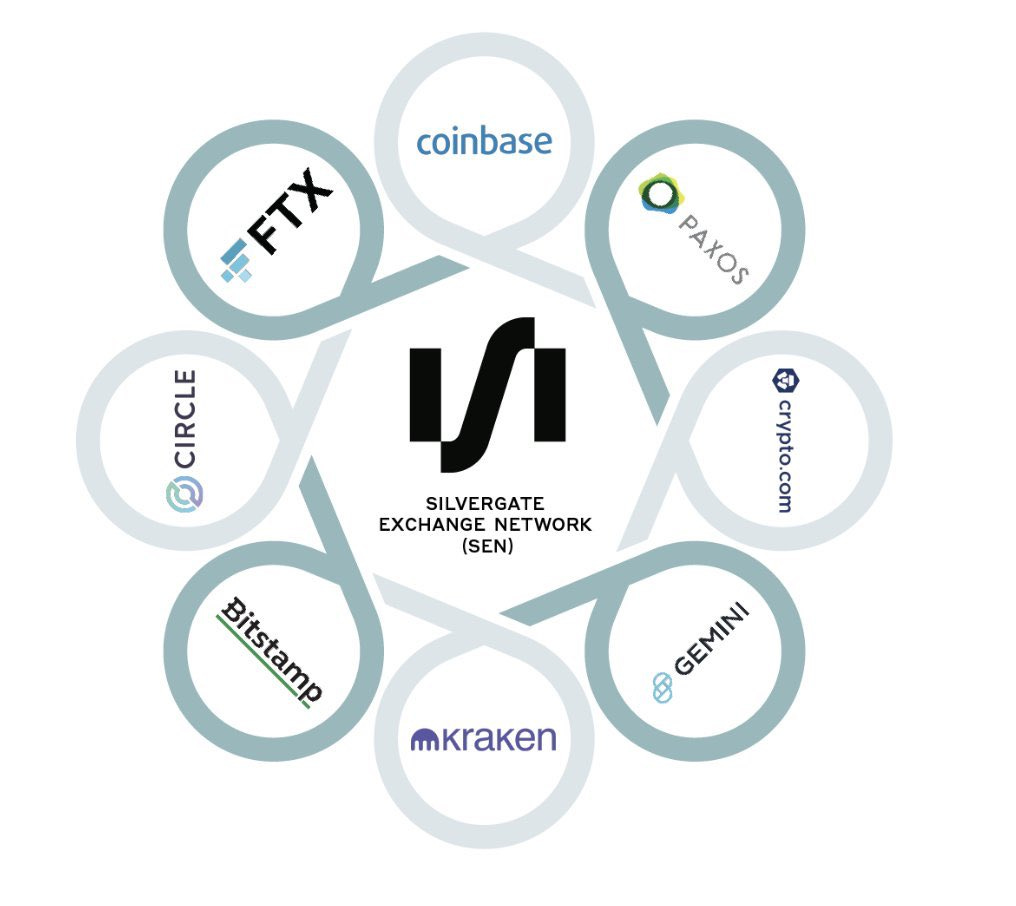

Silvergate ($SI)

Who is Silvergate? Basically, the long story short is that they used to be a small community bank in California for a few decades, and around 10 years ago they decided to shift their focus into providing traditional banking services for companies in the crypto world, especially exchanges. They were early to the game on that front because lots of banks were not willing to offer bank accounts to folks in the industry or their companies with all of the taboo things surrounding the industry like claims of criminal activity being rampant for example. Additionally, they wanted to be the bank of the future. The had a service called the Silvergate Exchange Network (SEN) that allowed customers to do transactions 24/7 with others in the SEN which is better than only being able to do it during banking hours of course, and things like wire transfers were cheaper and faster because entities on the SEN were already vetted and verified. They also offered loan services, and they offer USD loans that can be collateralized with Bitcoin. They also have been working on creating their own stable coin. They have some of the biggest players in the game as customers (see below).

Now you probably see the problem. FTX was one of their clients, and the collapse of FTX has caused problems for Silvergate. Most notably the fact that FTX and Alameda were using the bank and making transactions. This has led to them being investigated. As you may recall, some of the charges FTX/SBF face include wire fraud. The line of questioning is at least, but not limited to how much Silvergate knew about FTX’s business dealings, and could they face any liability as a result?

Due to these events, Silvergate’s stock is down more than 90% from its all-time high. On Thursday, the stock price was down more than 40% on the day after more pieces of news regarding them came out including:

Massive withdrawals

Deposits declining from $11.9 billion to $3.8 billion in just 3 months

FTX held nearly 10% of deposits

$150 million of remaining balances held by firms who have declared bankruptcy

Many with way too much leverage

To raise cash, they sold $5.2 billion of debt securities with a net loss of $718 million

Silvergate also announced they are laying of 40% of their staff which is ~200 employees

The CEO Alan Lane says that Silvergate currently has enough cash on hand to cover all customer deposits. The bank is FDIC insured and does have a lot, if not all the same regulations other banks have. The difference is their willingness to deal with folks in this industry. Other major companies in the space may have difficulties finding traditional banking services if Silvergate can no longer operate. Silvergate still faces an uphill battle to survive, and it will be interesting to see how this plays out.

Macro

U.S. Federal Reserve

In the FOMC minutes released this week, officials agreed rate cuts shouldn’t happen in 2023 per the Wall Street Journal

Minneapolis Fed President Neal Kashkari says he expects another 100bps in rate hikes in 2023 to reach a peak rate near 5.4%

Atlanta Fed President Raphael Bostic said the central bank needs to keep raising rates

Researchers at the Kansas City Fed said lags in monetary policy are shorter than they used to be due to more central bank guidance

Fun fact: The Federal Reserve has never been audited in their 109 years of operation, meanwhile Bitcoin is audited every 10 minutes by thousands of people globally!

Stocks/Bonds in 2022

These next couple charts are from @charliebilello on Twitter

I highly recommend following him, he posts lots of great macro charts often!

This one shows the classic 60-40 stock-bond portfolio, and how it was the worst year for this type of portfolio since 1937!

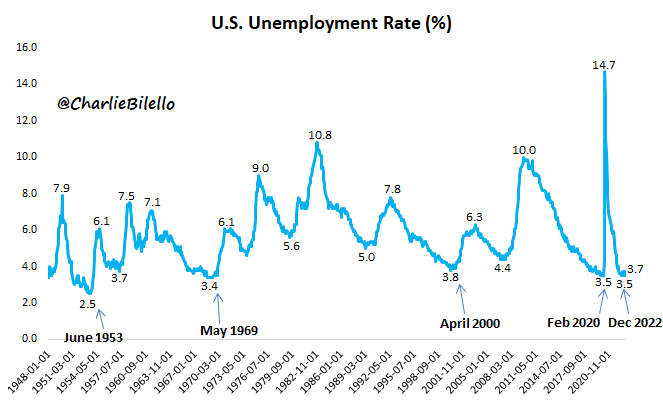

Labor

This one shows how unemployment is near the lowest it has ever been

As long as this is the case, the Fed will feel like there is runway to keep raising rates

This is why for now good economic data can be bad news for the markets

This chart from @LynAldenContact shows voluntary job quits

This also shows a strong labor market and keeps the Fed hawkish on rates

There are also ~10.5 million job openings in the United States today

Closing Thoughts

There is plenty of negativity to go around, and my take on the news and on what we can see into the future with charts and data is that things will continue to get worse before they get better. Because of this, it is important to plan ahead and know what your “why” is when it comes to not just investing, but in all areas of your life. This has been the biggest reason for my success as an investor I believe. I don’t care if the market goes up or down, but what I know is because I have planned out my own “why” and built my strategy around that. I know regardless of what happens I am in position to win, and I am ready to ride the waves any way they come!

Here is a chart I found interesting from Michael Saylor about the performance of Bitcoin since MicroStrategy started buying:

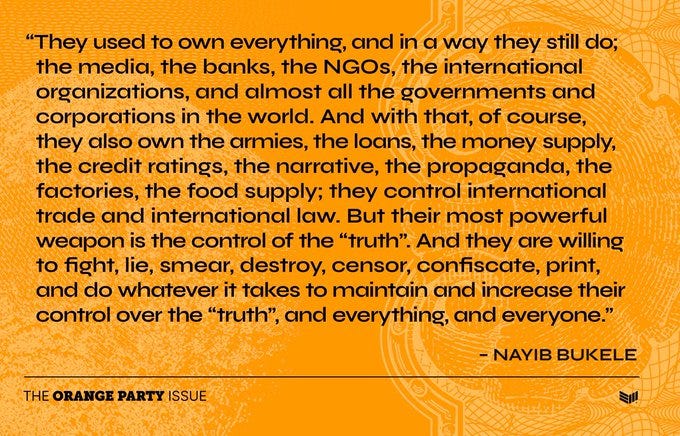

Here are few quotes that keep me bullish on Bitcoin:

Nayib Bukele is the president of El Salvador, one of two countries where Bitcoin is legal tender.

Lastly a quote from billionaire investor Charlie Munger about learning:

Disclosures:

I am not a financial advisor, and whatever I post should not be taken as financial advice. It is for education and entertainment purposes only. Anything I post does not constitute an offer to sell or trade, a solicitation to buy, or recommendation for any security, cryptocurrency, digital asset, or related product, nor does it constitute an offer to provide investment advice or other related services by myself or Minerva Digital Asset Education, LLC. I and/or Minerva Digital Asset Education, LLC may have a financial investment with the cryptocurrencies/digital assets discussed. In preparing the content created, no individual financial or investment needs of the viewer have been considered nor is any financial or investment advice being offered. Any views expressed in the posted content were prepared based upon the information available at the time such views were written. Changed, new, and/or additional information could cause such views to change.