Announcements

With January coming to an end, I will begin to operate the “freemium” model with the newsletter/Substack as a whole. Following this week’s newsletter, only paid subscribers will get instant access to the current-week newsletter, and free subscriptions/non-subscribers will be able to access the newsletter 2 weeks later. I still think the news will be relevant even 2 weeks later but want to give value to the paid subscribers. For the more static educational articles, the paid subscribers will have instant access, and free subscriptions/non-subscribers will get a delayed release, or maybe even no release at all depending on the article.

I plan to add things like podcasts, monthly news recaps, in-person and virtual educational opportunities, and more in the coming months to Minerva Digital Asset Education, LLC’s service offerings.

Feel free to reach out to me if you:

Are interested in any new services I plan to offer

Want to collaborate in an article/podcast

Want to provide me with any feedback (good or bad)

I want to continue to add value to everything I am doing and appreciate the support from everyone whether you are a free subscriber, or a paid subscriber!

Exchanges

FTX

Former FTX US president Brett Harrison has raised $5 million for a crypto software startup with investments including Coinbase Ventures (major centralized exchange) and Circle Ventures (issuers of the popular stablecoin USDC) per Bloomberg

Crypto lender Blockfi had $1.2 billion tied up in FTX

The document that showed this information was supposed to be redacted but was uploaded mistakenly without the proper redactions!

A court filing shows that FTX owes money to Apple, Coinbase, Binance, Netflix, Southwest Airlines, Goldman Sachs, JP Morgan Chase and many more!

Court filings show that SBF and other FTX employees could be forced to provide financial records and show any money received from FTX to investigators

Joseph Bankman (SBF’s father) who is a law professor at Stanford, offered tax advice to FTX employees and helped recruit FTX’s first lawyers per court filings

Gabriel Bankman-Fried (SBF's brother) founded an organization that lobbied members of US Congress

FTX also asked a judge to question SBF’s family under oath about any money they received from FTX

Prosecutors seized $50 million from Sam Bankman-Fried’s (SBF) account in a rural Washington State bank called Farmington State Bank

SBF purchased an $11 million stake in the bank last year

Late this week it was reported that authorities want tighter restrictions for SBF’s bail because he has been contacting witnesses, and others involved in the case, sometimes using encrypted messaging channels

Business Insider is reporting that Caroline Ellison and Gary Wang are no longer cooperating with the investigation into FTX and have declined to give FTX lawyers requested information

Binance

Binance said that one of their traditional banks they used will only handle transactions >$100,000 starting February 1st as that bank tries to shift away from digital assets

There was speculation when this released that more banks are doing it, but it appears to just be this bank’s policy

I don’t see this as much to worry about if at all

This creates a potentially positive impact on Silvergate bank who is facing lots of challenges to remain in business

Cointelegraph reported that anonymous digital asset wallets purchased digital asset tokens prior to them being listed on Binance

Typically, a token will see an increase in price when they get listed with Binance and many other major exchanges see this happen too

Binance instituted a policy prohibiting employees or family members from selling tokens that list on Binance for the first 90 days recently

Binance acknowledged that it kept funds they used for collateral in wallets with customer funds in the past per Bloomberg

They have since taken actions to make sure they avoid making this mistake going forward

Gemini

In a bankruptcy filing, Genesis offered ~$600 million worth of $GBTC shares to help make Gemini Earn users whole

Gemini Earn customers need ~$900 million to be made whole

Gemini is laying off 10% of their staff

Celsius

Bankrupt exchange Celsius plans offer customers a coin that is basically an IOU to pay them back

Lawyers in the Celsius bankruptcy case claimed there were no compelling bids for their remaining assets

This was said despite reported offers from Binance, Bank the Future, Cumberland, and Galaxy Digital

Digital Asset Regulation

This week there was a press release by the Biden White House called “The Administration’s Roadmap to Mitigate Cryptocurrencies’ Risks”. If you would like to read it, you can find it here.

The way I see the post, is that it is more of a puff piece. They are acting like they are doing things, and have been working on things for “over a year” as they claim to help “protect investors”. They cite failures of stablecoins and exchanges, but here are they are acting like they can make a difference many months after the fact. It felt as though they are trying to lay the groundwork to increase the power of the executive branch, and of federal enforcement agencies in regard to regulating digital assets. I did not disagree with all the points made in the press release. I agree that there should be legislation/regulation to offer more transparency to customers, which could have prevented some of the issues of the last year, or at least made their negative impact far less reaching across the industry.

They said they will be laying out more what they plan to do in the next few months, and did not give many details as to what they were actually going to try and do. I think they understand that things like Bitcoin are a major threat to the U.S. dollar’s status as a global reserve currency, and I do not expect the U.S. to step aside from that without putting up a fight. What happens here may have a massive impact on the future of the United States, and if our country will continue to be a leader in innovation, especially in Web 3. If there is not fair regulation, companies will leave and bring that innovation somewhere else. It will be very interesting whether they choose to embrace this new technology that we can take advantage of, or if they choose to fight it and force the innovation to leave, which will harm all U.S. citizens.

The SEC rejected a BTC spot ETF application from Ark Invest’s Cathie Wood and 21Shares per Coindesk

The U.S. Senate Finance Committee had an educational briefing on the benefits of Bitcoin mining this week

The state of Missouri introduced a bill in their state legislature that would outlaw discriminatory practices against Bitcoin miners

The state of Mississippi also introduced a bill in their state legislature that would outlaw discriminatory practices against Bitcoin miners

Digital Currency Group-Genesis

Grayscale (subsidiary of Digital Currency Group (DCG)) has sued the SEC over conversion of $GBTC from a trust to an ETF

This week it was ruled that the lawsuit will move forward and oral arguments will begin on March 7, 2023 per CNBC

CEO of Grayscale, Michael Sonenshein appeared on CNBC this week and did an interview

He was asked about the conversion of the trust to an ETF and said they would only do a tender offer with shareholders after the judicial process runs its course

He was also pressed on lowering the high fees of $GBTC and digital asset trusts

He said they are in a “competitive environment”

He said they are committed to lowering fees

Becky Quick of CNBC said “why don’t you just do it instead of committing to it”

His response was that it costs more to do things in the digital asset space than with traditional finance

In my experience things can be made a lot cheaper in Web 3 than in traditional finance

They can and should hold the Bitcoin in cold storage, which does not cost anything outside of the upfront cost of the wallet, whereas custody of more traditional assets would be more costly to store, insure, etc.

Misc. News

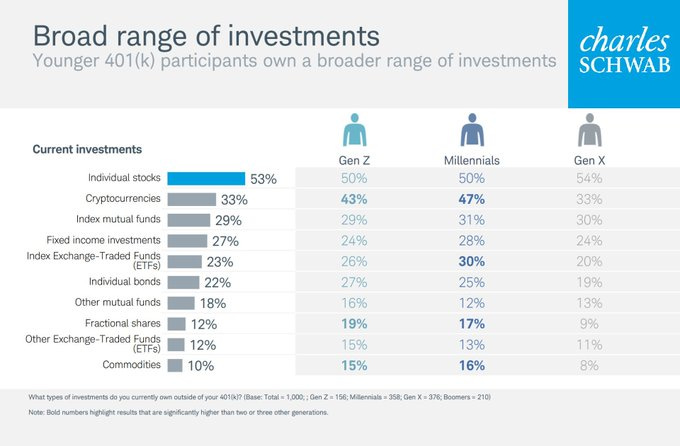

Charles Schwab reported that 47% of millennials and 43% of Gen Z with retirement accounts own cryptocurrency

It is rumored that Amazon may have a big push into Web 3 with an NFT initiative this Spring

California’s DMV will use the Tezos network to test digitization of car titles as NFTs

This week it was reported that Argentina and Brazil want to create a common currency, and plan to invite other Latin American countries to take part

Inflation hit 94.8% in 2022 in Argentina!

Inflation was as high as 12.1% in Brazil in 2022

Per Documenting Bitcoin (@DocumentingBTC on Twitter) the Bitcoin network transacted more $ volume than Visa and Mastercard COMBINED last year

Bitcoin: $42 trillion

Visa: $14.1 trillion

Mastercard: $7.7 trillion

This week Visa’s CEO stated they believe stablecoins and CBDCs can play a meaningful role in the payments space

Notice that they didn’t mention BTC, ETH, or others

Edward Snowden commented on the Bitcoin Lightning Network this week

He said “When normal people and businesses realize global money transfers can be borderless, instant, free, and only take 2 clicks, things are going to get very interesting.”

The lightning network is a layer (L2) built on top of Bitcoin

I plan to do a future educational article to cover this further 😊

Despite this fact, Chair of the new Digital Asset Committee in Washington DC said “Bitcoin takes so long my coffee gets cold. Its not ready for payments”

Are you surprised someone in Washington DC is in charge of a committee that they don’t appear to understand anything about?

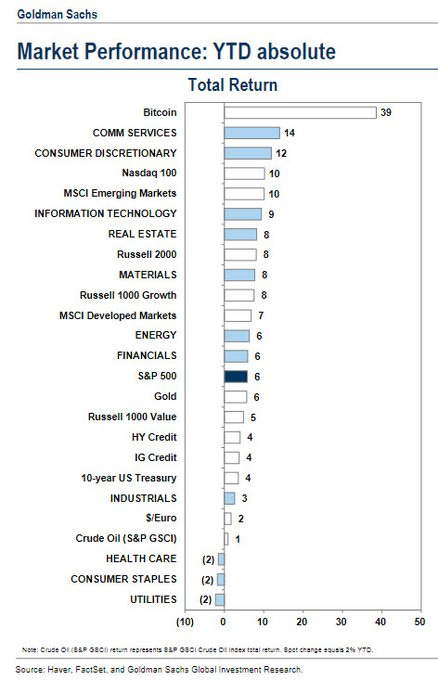

Bitcoin is outperforming many other mainstream investment segments YTD per Goldman Sachs

Disclosures:

I am not a financial advisor, and whatever I post should not be taken as financial advice. It is for education and entertainment purposes only. Anything I post does not constitute an offer to sell or trade, a solicitation to buy, or recommendation for any security, cryptocurrency, digital asset, or related product, nor does it constitute an offer to provide investment advice or other related services by myself or Minerva Digital Asset Education, LLC. I and/or Minerva Digital Asset Education, LLC may have a financial investment with the cryptocurrencies/digital assets discussed. In preparing the content created, no individual financial or investment needs of the viewer have been considered nor is any financial or investment advice being offered. Any views expressed in the posted content were prepared based upon the information available at the time such views were written. Changed, new, and/or additional information could cause such views to change.